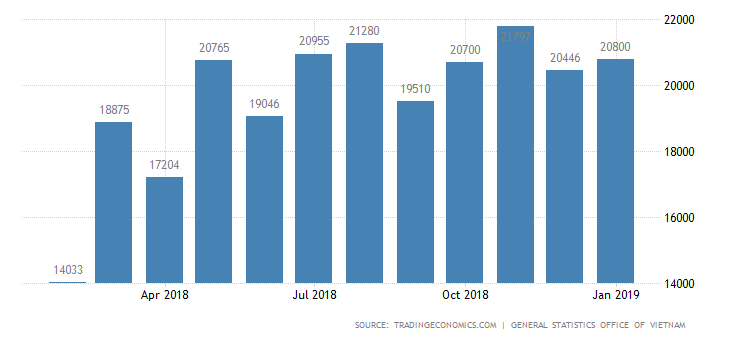

Import & Export Growth In Vietnam 2018/19

Vietnam’s export value recorded US$244.7 billion in 2018, representing a year on year growth of 13.8%, also continued to be a bright spot in the Vietnamese economic landscape in the year. This helped drive the economic increase to 7.08 percent.

Record 29 billion-dollar exports

According to the General Statistics Office, the domestic financial industry earned US$69.20 billion from exports, while the foreign-invested sector made US$175.52 billion. As many as 29 exports brought home at least US$1 billion each in the calendar year, accounting for 91.7percent of the nation’s total export value.

Telephones and components earned US$50 billion in 2018, up 10.5% year on year, followed closely by clothes and textiles with US$30.4 billion (up 16.6%); electronic equipment, computers and components with US$29.4 billion (up 13.4%); machinery, equipment and spare parts with US$16.5 billion (up 28 percent ); and apparel with US$16.3 billion (up 11 percent ). For example, they accounted for 99.7% of telephones and components; 95.6percent of electronics, components and computers; 89.1% of machinery, equipment and tools; and 59.9percent of clothes and fabrics.

Besides, many agricultural exports secured high growth. In particular, seafood exports reached US$8.8 billion, up 6.3%; fruit and vegetable exports plummeted at US$3.8 billion, up 9.2%; java shipments rose 1.2percent to US$3.5 billion despite decreasing prices as a result of a 20.1% increase in quantity; and rice exports reached US$3.1 billion, up 16%.

Garments & Textile Leading Exporter

Some exports of Vietnam confirmed their status in the world market as a result of high validity and big scale. Some crucial exporting industries like garment and fabric and leather and apparel have asserted their rankings in the world industry. Vietnam’s garment and textile exports surpassed Bangladesh in 2018 to be the next biggest exporter of rice, just behind China and India. Vietnam was right behind India.

On the export market, according to the General Statistics Office, the United States has been the biggest export market of Vietnam, producing US$47.5 billion, up 14.2% year on year. The export value of phones and parts, footwear and apparels climbed 46.7%, 15.3% and 13.7%, respectively. The European Union (EU) came second with US$42.5 billion, 11 percent higher than one year ago.

The export value of electronic equipment, computers and components; phones and parts; and apparels to this market expanded 23.2%, 16.2% and 10.5%. Vietnam’s imports to China were worth US$41.9 billion in 2018up 18.5% year on year, with phones and components rising by 52.8%; electronic equipment, computers and parts by 25.8%; and fruits and veggies by 10.2%.

Importing & Exporting In The ASEAN Region

ASEAN attracted US$24.7 billion to Vietnam, up 13.7%, with rice climbing by 105.5 percent; iron and steel by 39.1 percent; and garments and fabrics by 37.4%. Shipments to Japan reached US$19 billion, up 12.9%, with garments and textiles climbing by 24.8 percent; electronics, computers and components by 14.1%; and machinery, equipment and components by 7.7%. Exports to South Korea valued US$18.3 billion, an increase of 23.2 percent, with electronics, computers and parts expanding by 40.8%; clothes and fabrics by 32.6%; and telephones and parts from 12.6%.

US$7.2 billion: Trade surplus at all time high

In accordance with the General Statistics Office, Vietnam’s import value rose 11.5% year on year to US$237.5 billion in 2018, with 36 things taking at least US$1 billion in Vietnam, accounting for 90.4percent of total import spending. Four imports took US$10 billion.

Vietnam ran a trade surplus of US$7.2 billion in 2018, the greatest in history and much higher than the target set by the National Assembly.

Indeed, the trade balance was always a surplus because 2016. The trade surplus was US$1.78 billion and US$2.11 billion in 2016 and 2017, respectively. Good control of trade balance was attributed to a rise of foreign exchange reserves, which eased exchange rate pressures, stabilized the currency market and enhanced the international payment equilibrium.

This result partly came from market opening. A growing number of businesses utilized free trade agreements, particularly with such markets as South Korea and Japan. In all markets which Vietnam signed FTAs, it enjoyed high export development, such as South Korea (23.2percent ), ASEAN (13.7%), Japan (12.9%), the EU (11 percent ), the U.S. (14.2%), and China (18.5percent ).

In addition, streamlined administrative procedures and company investment conditions also facilitated businesses to raise exports.

Many Vietnamese businesses tried to grow to combine value chains for greater performances. This showed that national production also recovered very strongly.

Great Opportunities In Vietnam For Exporting Goods

Export in 2019: Much room for expansion

The positive export outcomes in 2018 will place greater pressure on export targets in 2019. But, according to specialists, much room remains for export expansion in 2019.

The Ministry of Industry and Trade prediction Vietnam’s export value at US$258 billion, 8-10% higher than in 2018. This is a struggle amid many unfavorable conditions on commerce. But, there are still many chances.

Further Export Solutions In Vietnam

Primarily, merchandise exports will develop more on better investment and business environment. In particular, the official effectiveness of the in depth and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in ancient 2019 and the anticipated signing and authorities of the Vietnam – EU Free Trade Agreement (EVFTA) in 2019 are devoting a powerful pull on foreign direct investment flows which enable Vietnam to have powerful production power. Vietnam’s key exports will have a massive opportunity when these free trade arrangements take effect. Especially, the CPTPP is predicted to provide a powerful boost to many businesses in Vietnam, including garment and textile, leather and footwear as well as fishery.

Secondly, more companies invest more to enhance product quality and pursue sustainable export growth. This is an important element for stronger export growth in the coming time.

To attain this aim, the Ministry of Industry and Trade also proposed some significant options like expanding production, enhancing product quality and growing markets. The ministry underlined solutions to improve export, link creation and processing chains, control input sources, follow regulations origin to take advantage of tariffs.

Additionally, the ministry will review and evaluate impacts of signing and implementing FTAs on each sector to tune up sector development strategies. Trade promotion is going to be made for specific products.

BM International Groups Import & Export Division believes that through partnering with a strong and trustworthy Import & Export company who understands the latest import and export regulations in Vietnam and coupled with these export solutions, Vietnam and companies who look to utilise this market have more chances to make more powerful breakthroughs in 2019 and achieve all objectives

0 comments